A Biased View of P3 Accounting Llc

Wiki Article

The smart Trick of P3 Accounting Llc That Nobody is Talking About

Table of ContentsSome Known Details About P3 Accounting Llc The 7-Minute Rule for P3 Accounting LlcLittle Known Questions About P3 Accounting Llc.Not known Details About P3 Accounting Llc P3 Accounting Llc - Truths

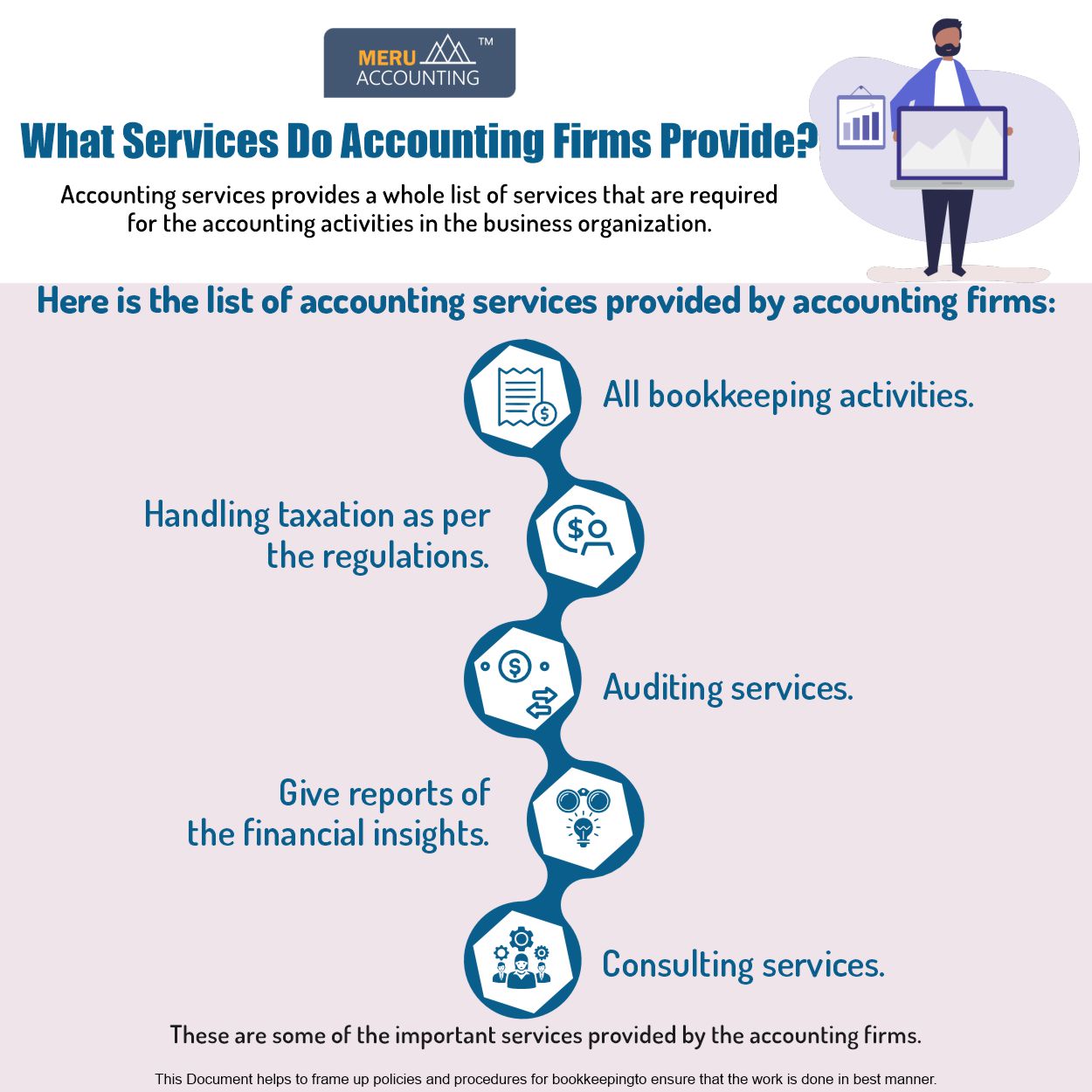

We have a team of over 200 specialists with diversified backgrounds. We concentrate on supplying accountancy solutions to professional service organizations. We offer more than two loads specialized market practice teams with deep understanding and wide experience in these fields: Literary Providers; Agencies; Innovation, Web, Media and Entertainment; Building And Construction; Manufacturing, Selling and Circulation; Maritime, and Price Partition Teams.By Kimberlee Leonard Updated March 04, 2019 Audit firms offer a myriad of services that aid company owners remain economically organized, tax obligation certified which assistance get ready for business development. Company owner shouldn't check out an accountancy company merely as an outsourcing expense for bookkeeping however as an essential business partner.

While some accounting companies specialize in specific niche solutions such as tax obligation method, many will offer accounting and payroll services, tax obligation preparation and company appraisal services. There is much even more to exhaust planning and preparation than completing income tax return, although audit firms prepare both state and federal corporate tax returns. Accountancy companies likewise prepare year-end service papers, such as internal revenue service proprietor K-1, worker W-2 and 1099-Misc types.

Additionally, company proprietors need to establish service entities that produce most positive tax obligation circumstances. Accountancy companies assist identify the most effective services which help in the production of entities that make the ideal tax obligation feeling for the business. Some estate preparation demands are one-of-a-kind to lots of local business owner, and an accountancy company assists determine these.

3 Simple Techniques For P3 Accounting Llc

Firms will certainly collaborate with estate planning lawyers, monetary organizers and insurance coverage agents to carry out long-term methods for company transfers and to minimize inheritance tax. Many company owners are excellent at giving the product and services that is the foundation of business. Company owners aren't always professionals at the economic elements of running an organization.Copies of company bank accounts can be sent out to accounting firms that function with accountants to keep precise cash money circulation records. Accountancy companies likewise create profit and loss statements that damage down essential areas of costs and earnings streams (https://experiment.com/users/ibowden). Accountancy firms additionally may help with accounts receivable and handle outbound monies that include supplier payments and pay-roll processing

Accountancy firms are essential when an organization needs to produce evaluation records or to obtain audits that financing companies need. When an organization seeks a car loan or funding from a private financier, this purchase requires to be properly and properly valued. It is also necessary for potential mergings or purchases.

Some accountancy firms additionally help new organizations with pro forma economic declarations and forecasts. real estate bookkeeping OKC. Pro forma financials are utilized for preliminary funding or for service development. Bookkeeping firms make use of sector information, in addition to existing business economic history, to calculate the information

How P3 Accounting Llc can Save You Time, Stress, and Money.

The Big 4 additionally offer electronic makeover speaking with to serve the requirements of companies in the digital age. The "Big 4" refers to the four biggest accountancy firms in the U.S.The largest audit firms used to consist of the "Big Eight" however mergers and closures have lowered the variety of top tier business.

or U.K. entities. Arthur Young combined with Ernst & Whinney while Deloitte Haskin & Sells merged with Touche Ross to decrease the team count to six. Then, Rate Waterhouse and Coopers & Lybrand combined their methods, making the total 5. Following the collapse of Arthur Andersen, as a result of its tested guilt in the Enron scandal, the five came to be the present-day 4.

The smart Trick of P3 Accounting Llc That Nobody is Discussing

As a matter of fact, the huge majority of Fortune 500 business have their financial declarations audited by among the Big 4. Big 4 clients include such business powerhouses as Berkshire Hathaway, Ford Electric Motor Co., Apple, Exxon Mobil, and Amazon. According to a 2018 record by the CFA Institute, 30% of the S&P 500 were investigated by Pw, C, 31% by EY, 20% by Deloitte, and 19% by KPMG.With 360-degree sights of firms and markets, the Big Four are authorities in business. They have substantial recruiting and training programs for fresh grads and offer valued conduits for tax obligation and consulting professionals to and from numerous commercial fields. Each Big 4 company is a make-up of specific expert solutions networks instead of a single company.

Despite general business development, Deloitte's 2021 United States income declined from 2020. In 2021, Pw, C reported yearly earnings of $45. 1 billion, the second greatest quantity for Big 4 companies but just up 2% (in its local currency) from the year prior. Profits in the USA continued to be flat, though Pw, C is currently investing $12 billion to add 100,000 new jobs over the next five years to reinforce its worldwide existence.

Worldwide, Pw, C operates in 152 countries and its international labor force numbers 328,000 people. During financial year 2021, Ernst & Youthful reported about $40 billion of company-wide income, a rise of 7. 3% from the year prior. EY has actually videotaped 7. 3% substance annual growth over the previous seven years.

Report this wiki page